Dear Shareholders,

I am pleased to present the annual results of Pou Sheng International (Holdings) Limited (the “Company” and together with its subsidiaries, the “Group”) for the financial year ended December 31, 2023, to the shareholders of the Company (the “Shareholders”).

2023 was a year of moderate recovery in the mainland China. Sales momentum and foot traffic at physical retail stores improved supported by a low base effect, while the progress remained uneven due to dynamic retail environment and segmented consumption patterns. Sales remained volatile especially in the second half of the year, amid weaker consumer confidence across the economy.

Despite encountering stronger-than-expected challenges, the Group focused on agility and sustained growth backed by a range of initiatives to ensure a decent profitability recovery. These encompassed store-level optimisation, digital transformation, cost reduction, efficiency enhancement and effective inventory management. While operating in a competitive promotional environment, we effectively managed discount levels and improved our inventory and inventory days to a healthy level by year-end through excess inventory clearance. Our sales and cash conversion efficiency were also supported by our inventory integration programme, through which we efficiently facilitated product sharing with our brand partners, further optimising inventory mix.

Brand partners fine-tuned its channel strategies and reprioritised wholesale relationships. As an indispensable strategic enabler, we further intensified our collaboration with brand partners, particularly in areas such as impeccable and diverse shopping experience and consumer connectivity by leveraging its extensive channel networks and the strength of retail operational capabilities. We also deepened the connectivity and integration of our membership programmes, allowing consumers to access member-exclusive products and services that are consistent available through our stores and stores directly operated by our brand partners in the Greater China region.

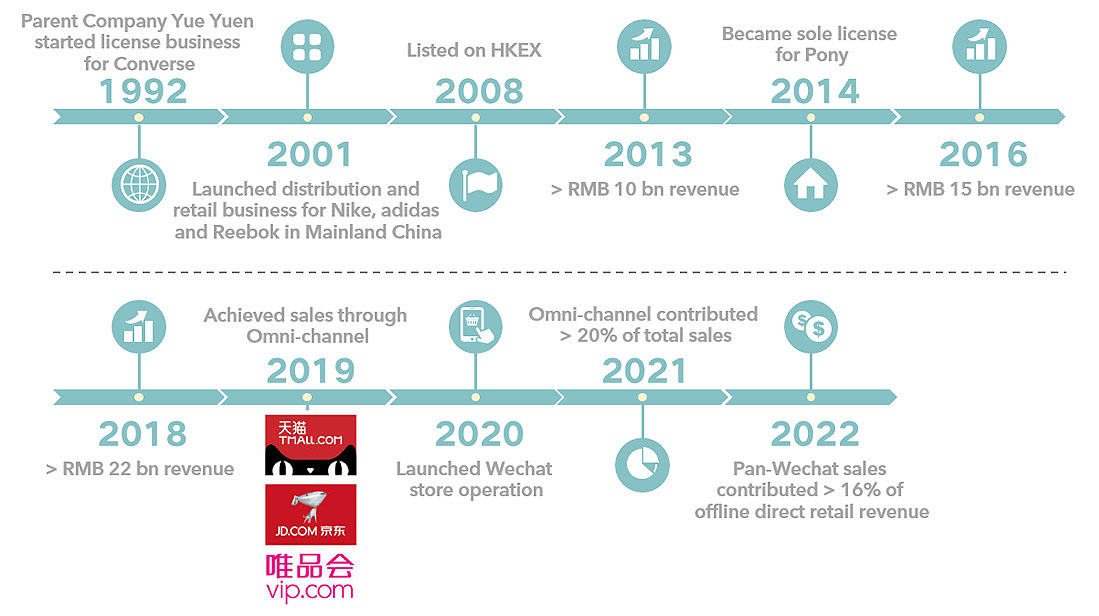

We proactively developed the higher-margin private traffic domains of our omni-channels, with sales enacted through our customised, client-centric Pan-WeChat Ecosphere as we continued to expand the digital-enabled and premium experience through our WeChat stores and Douyin live-streaming by Key Opinion Staff, which supported a robust growth of 22% for the overall omni-channels. The development of this channel is at the core of our digital transformation strategy, which aims to more closely knit our offline social presences and online communities together with a human touch, encouraging better conversion rates and incremental sales, shorter sales cycles and more full-price in-season sales.

Over the past twelve months, we have diligently worked on our SAP project to seamlessly integrate business and finance. The system officially commenced operation at the beginning of 2024, covering from finance, business and operations to performance indicator monitoring. This initiative lays a foundation for optimising decision-making efficiency at the management level.

The Group’s solid financial strength well reflected the results detailed above, which helped us to make the very first interim dividend payments since 2016. Together with the proposed final dividend, the full year dividend payout ratio shall reach 30%, showcasing our commitment to increase shareholders’ return. Heading into 2024, we will continue to leverage on the digital optimisation to enhance our highly agile and flexible decision-making, prioritise our margins and deepen our strategic partnerships with brand partners to drive quality growth, accelerate sales and facilitate a virtuous inventory cycle, while adopting a holistic approach to channel planning and management in light of the ongoing volatility in consumer confidence levels as macroeconomic headwinds persist.

According to the China Outdoor Sports Industry Development Report (2022-2023) 《中國戶外運動產業發展報告 (2022-2023)》released by the General Administration of Sport of China, the “post-90s” generation is now the largest consumer segment in the outdoor activities market, making up 36.1% of consumers, with women accounting for 59.9% of sports participants. According to the latest McKinsey Sporting Goods Report 2024, the consumer group over the age of 45 is projected to exhibit the most rapid spending growth in mainland China, with a CAGR ranging from 8.3% to 9.7% up to 2025. The demographic split in mainland China creates a favourable opportunity for sporting goods brands. In addition to the current marketing campaigns that primarily target younger consumers with more women-focused, the older generation presents a relatively untapped demographic with the potential to unlock a lucrative market. Looking ahead, capturing opportunities in segmented market and diversifying channels will be especially important for appealing to and reaching consumer bases that are more diverse and digital-first than ever.

The report also highlighted that the global sportswear market is projected to experience a CAGR of 7% from 2023 to 2027, with Asia Pacific region anticipated to achieve a CAGR of 10%. We still see immense growth potential in the Chinese sports market, which will continue to lay a clear runway for the long-term growth of our business. According to the China Marathon Platform, 580 road running events were held across mainland China in 2023, attracting 5.5 million participants, further encouraging the wellness trend of “Make Sports Your Life”.

Wider sports participation will also be supported by upcoming global mass sports events throughout the year, including the Summer Olympics in Paris, the AFC Asia Cup in Qatar and the UEFA Euro Cup. Closer to home, the return of the ATP and WTA worldwide professional tennis tours to mainland China will also support the development of the local sports industry.

We will seek to fully capitalise on these opportunities and the general growth trend, providing both experienced and new sports aficionados with a memorable shopping experience by leveraging our competitive edges, experience-driven physical stores, private and public traffic domains, membership programmes, and by further deepening our links and cooperation with our brand partners.

On behalf of the Group, I would like to express my sincere gratitude to our customers, business partners, financial institutions, shareholders and my dedicated colleagues for their continual support, trust and efforts. We look forward to promising years ahead, bringing quality return to the shareholders.

Yu Huan-Chang

Chairman

Hong Kong

March 13, 2024

WANG Jun, is currently the Chief Executive Officer of the Company (the “CEO”) and directly in charge of the Merchandise & Retail Business Unit. He once was the Acting CEO during the period from July 2022 to March 2023. Mr. Wang is also a director of various subsidiaries of the Company. He joined the Group as a Vice President, in charge of Brand and Merchandising Management Department in April 2014. Mr. Wang graduated from the Department of Marketing of the Capital University of Economics and Business in Beijing. He has extensive experience and achievements in strategic planning, sales marketing, product branding and retail operation.

CHANG, Su-Ching, is currently a Vice President of the Group, in charge of the Omni Channel Platform and Operation & Business Management Department. She is also a director of various subsidiaries of the Company. She was appointed as the Vice President of Finance Department of the Group in September 2011. Ms. Chang graduated with a Master Degree in Finance from National Taiwan University. She has more than twenty years’ working experience in treasury, cash management and financial planning.

SONG Hua, is currently a Vice President of the Group, in charge of the Second Division of the Merchandise & Retail Business Unit. He is also a director of various subsidiaries of the Company. He joined the Group in December 2008, and was promoted to be a Vice President in March 2018. Mr. Song graduated from the Department of Industrial Electrical Automation of North University of China. He has extensive experience and achievements in strategic planning, sales marketing, product branding and retail operation.

TANG Guoxing, is currently a Vice President of the Group, in charge of the Brand and Channel Development Headquarters. He is also a director of several subsidiaries of the Company. He joined the Group in December 2010, and was promoted to be a Vice President in March 2019. Mr. Tang graduated from Jiangsu Open University (formerly known as Jiangsu Radio and Television University), specialised in Business Enterprise Management. He has extensive experience and achievements in strategic planning, sales marketing, product branding and retail operation.

YIP Wing Ming, is currently the Company Secretary and the Financial Controller of the Company. He is also a director of various subsidiaries of the Company. Mr. Yip joined the Company in February 2017. He holds a first class honours degree of Bachelor of Business Administration in Finance and Economics from The Hong Kong University of Science and Technology. Mr. Yip is a member of the Hong Kong Institute of Certified Public Accountants. Prior to joining the Company, he worked for an international audit firm. Mr. Yip has over ten years of extensive experience in accounting, auditing and financial management.